- Web

- Feb 05, 2026

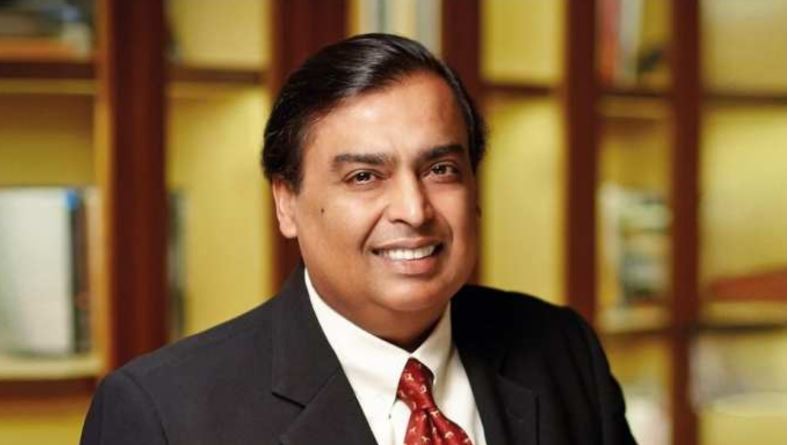

India’s billionaire titans fall from the $100 billion ranks

-

- Web Desk Karachi

- Dec 16, 2024

Mukesh Ambani, the chairman of Reliance Industries Limited, and Gautam Adani, founder of the Adani Group, are confronting significant challenges that are impacting their immense wealth, as reported by Bloomberg. Ambani’s energy and retail sectors have been struggling as investor worry mounts over increasing debt. Meanwhile, Adani’s business empire is facing turmoil due to a probe by the U.S. Department of Justice over alleged bribery, which could restrict his access to funding and hinder contract opportunities. The future remains uncertain for both tycoons.

Adani’s recent troubles were exacerbated by U.S. prosecutors’ allegations made in November concerning bribery, drawing unwelcome media attention. He has been working hard to restore investor trust after short-seller Hindenburg Research’s report last year, which accused his firm of fraudulent activity. Adani, who has denied these allegations, remains determined to persevere, asserting at a recent event that his firm is dedicated to “world-class regulatory compliance” and that each challenge only makes them stronger.

These allegations are expected to weigh heavily on the Adani Group and its stock prices as the New Year approaches. His net worth peaked at $122.3 billion in June, following efforts to strengthen the company’s finances post-Hindenburg’s report, but has since plummeted to $82.1 billion, according to the Bloomberg Billionaires Index, following the bribery claims.

Ambani is also facing a decline in his fortune, albeit less dramatically. His wealth peaked at around $120.8 billion in July, coinciding with the lavish wedding of his son. However, his flagship corporation, Reliance, has struggled with reduced earnings in energy and falling consumer demand in retail. As of December 13, 2024, Ambani’s fortune stands at $96.7 billion.

Both businessmen have fallen out of the exclusive centi-billionaires club. Ambani is aiming for a strategic transformation of his conglomerate, focusing more on digital platforms, retail brands, and renewable energy to drive growth. However, growth in sales and profits at the retail sector has slowed, while digital competitors are making inroads in the grocery and household sectors, particularly in India’s major cities.

Additionally, the entry of Elon Musk’s Starlink into India’s satellite broadband market poses a potential threat to the successes of Ambani’s digital and telecom business, Jio Platforms Limited. His oil-to-chemicals sector also faces pressure from dwindling demand and competition from Chinese exporters. Still, Reliance harbors ambitious plans in the tech realm, including a joint venture with Walt Disney Co. to create an $8.5 billion media powerhouse poised to lead India’s streaming landscape, and an expansion of its partnership with Nvidia Corp. to develop artificial intelligence computing infrastructure in India.

Moreover, both Ambani and Adani are expected to encounter additional challenges in the New Year, particularly in light of Donald Trump’s election and the uncertain business landscape in India.