- Web

- Feb 05, 2026

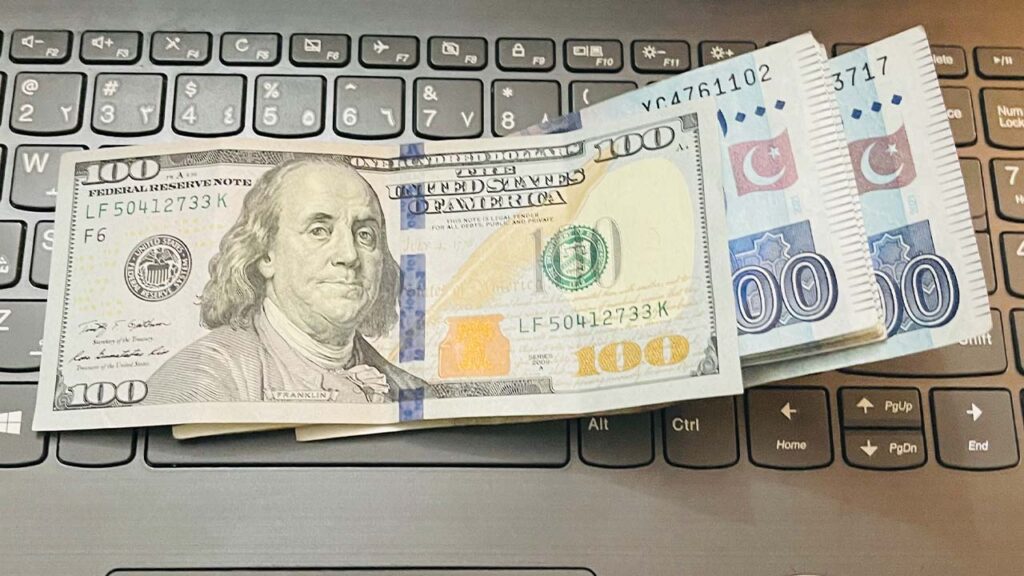

Interbank closing: Pakistani rupee ends week at Rs284.97

-

- Web Desk

- Dec 01, 2023

WEB DESK: The Pakistani rupee (PKR) displayed an appreciation of approximately 41 paisa against the US dollar (USD) this week, concluding at PKR 284.97 on Friday. This marks an improvement from the previous week’s closure at PKR 285.37 per USD.

In today’s trading session, the local currency demonstrated a gain of 20 paisa against the greenback, reaching an intraday high (bid) of Rs285.84 and a low (ask) of Rs285.

Interbank closing #ExchangeRate for todayhttps://t.co/vnEm6QRcGW#SBPExchangeRate pic.twitter.com/BD7DIQ5kMX

— SBP (@StateBank_Pak) December 1, 2023

In the open market scenario, the local unit observed a gain of 50 paisa, as exchange companies quoted the dollar at 283.5 for buying and 286.5 for selling. This compares to the prior day’s figures of Rs284 for buying and Rs287 for selling.

It’s noteworthy that this represents the third consecutive weekly gain for the local unit against the U.S. dollar.

Relative to major currencies, the PKR exhibited gains against the Euro, strengthening by 1.87 rupees and closing at Rs310.5, compared to the previous value of Rs312.37.

The British Pound experienced a decrease in value of Rs2.12, closing at Rs360.05 compared to Rs362.18 from the previous day.

The Swiss franc incurred losses of 90.37 paisa, concluding at Rs325.88 compared to Rs326.78 from the previous session.

Against the Japanese yen, the PKR gained 1.82 paisa, closing at 1.922 versus 1.94 a day ago.

The Chinese Yuan saw a decrease of 10.36 paisa, closing at 39.8829 against 39.9865 from the previous session.

The Saudi Riyal closed at 75.97 with a loss of 4.58 paisa from its value of 76.01 a day ago. Similarly, the UAE dirham decreased in value by 5.6 paisa from 77.653 a day ago to 77.597.

Read more: Govt maintains petrol price

In the current financial year, the PKR has appreciated against the dollar by 1.02 rupees, or 0.36 per cent. However, the calendar year has witnessed a depreciation of PKR by 58.53 rupees, or 20.54 per cent.

Shifting focus to the money market, the benchmark 6-month Karachi Interbank bid and offer rates experienced a slight increase of 1 bps to 21.23 per cent and 21.48 per cent.

The State Bank of Pakistan (SBP) executed a reverse repo and Shariah-compliant Modarabah-based Open Market Operation (OMO) today, injecting a total of Rs1.288 trillion into the market.

Of this, Rs1.218 trillion was injected through reverse repo OMO, while the remaining Rs70 billion was injected through Shariah-compliant Modarabah-based OMO.

Additionally, the central bank conducted an auction on Wednesday, selling Market Treasury Bills (MTBs) worth Rs1.165 trillion for 3, 6, and 12 months against a target of Rs900 billion.

The cut-off yields for 3, 6, and 12 months were 21.4499 per cent, 21.4299 per cent, and 21.4300 per cent, indicating a decrease of 5 bps, 7 bps, and 7 bps, respectively.