- Web

- Feb 05, 2026

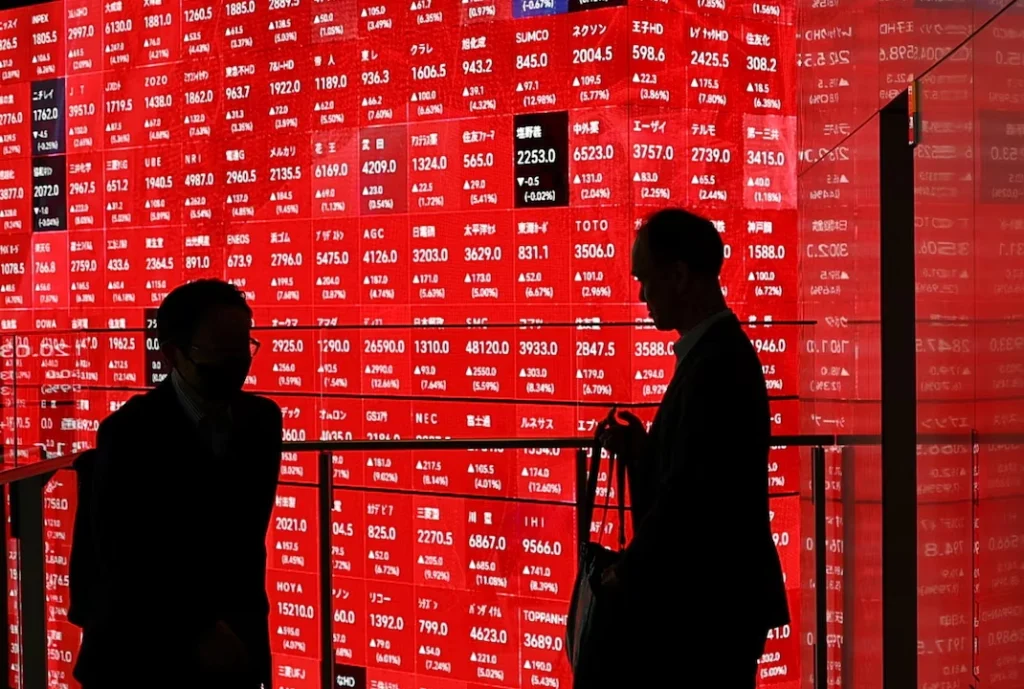

Japan leads Asian equity bounce, yields rise on trade optimism

-

- Reuters

- Apr 08, 2025

TOKYO: Asian stocks bounced off 1-1/2-year lows and US stock futures pointed higher on Tuesday, as markets caught their breath after recent heavy selling on hopes that Washington might be willing to negotiate some of its aggressive tariffs.

US Treasury yields continued their ascent from six-month lows, gold hovered close to a 2-1/2-week low and crude oil recovered from a nearly four-year low, as traders began shifting back to riskier assets from traditional safe havens.

Goldman Sachs raises odds of US recession to 45pc, second hike in a week

A 5.6 per cent rebound in Japan’s Nikkei far outpaced other regional markets, with Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer tasked with leading trade negotiations with Tokyo.

US business leaders have also begun speaking out about the damage to the economy and financial markets that could be wrought by President Donald Trump’s global trade war, with JPMorgan Chase CEO Jamie Dimon warning on Monday of inflation and a US slowdown.

However, Trump dug in his heels over China, vowing additional 50 per cent levies if Beijing does not withdraw retaliatory tariffs on the United States. Beijing said on Tuesday it will never accept the “blackmail nature” of US tariff threats.

Even so, Hong Kong’s Hang Seng climbed 1.7 per cent in early trading. Mainland Chinese blue chips added 0.6 per cent.

The Chinese yuan weakened to 7.36 per dollar in the offshore market, the weakest in two months.

“Importantly, a little ray of sunshine is starting to emerge that gives hope that the US is genuinely open to trade negotiations, … the most significant being Japan with Treasury Secretary Bessent,” said Tapas Strickland, head of market economics at National Australia Bank.

Strickland, however, noted volatility remains extremely elevated, with the “rare event” of the VIX index spiking as high as 60 overnight.

South Korea’s added 1.3 per cent and Australia’s equity benchmark gained 1 per cent.

Taiwan’s equity benchmark though sank 3 per cent, following its worst day ever on Monday, when it tumbled 10 per cent. The major semiconductor producer faces a 32 per cent duty from Washington.

Pan-European STOXX 50 futures rallied 2.2 per cent.

US S&P 500 futures rose 0.9 per cent, after the cash index ended a wild session with a 0.2 per cent loss on Monday.

China vows to fight US tariffs ‘to the end’

Wall Street swung between heavy losses and gains throughout the session as investors were whiplashed by tariff headlines. A media report claiming Trump was considering a 90-day pause in duties for all countries except China briefly turned US stocks positive early in the session, but it was quashed by the White House as “fake news.”

“The signs are there that if the market hears what it wants to hear then risky assets could explode higher,” said Chris Weston, head of research at Pepperstone.