- Web

- Feb 05, 2026

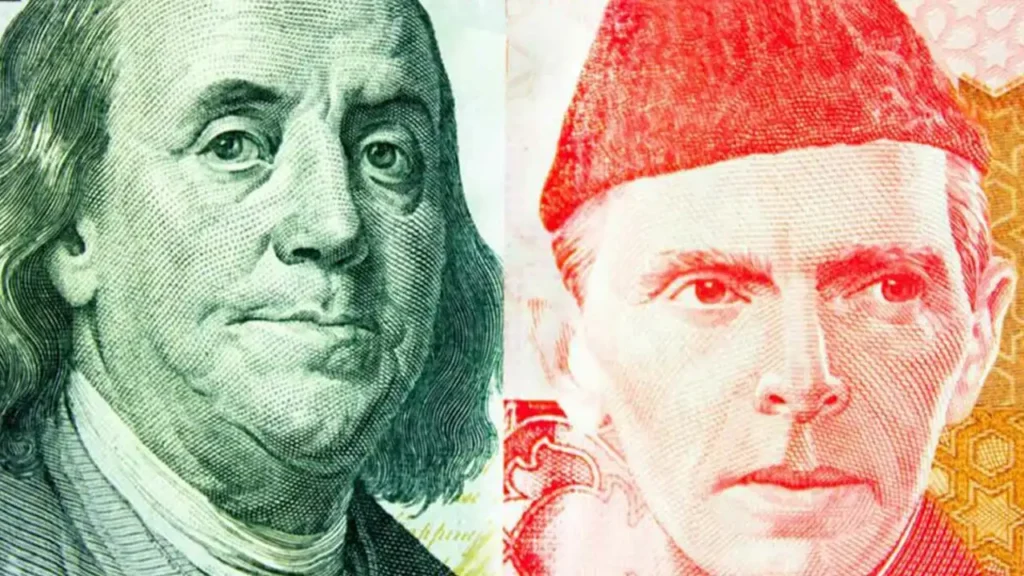

Intraday trade: PKR gains 29 paisa against USD

-

- Web Desk

- May 15, 2025

KARACHI: The Pakistani rupee recorded a slight gain against the US dollar in early trading on Thursday, appreciating by 0.1 per cent in the interbank market. The currency was seen trading around Rs281.43, up by 29 paisa from the previous session.

Despite the uptick, the rupee has largely remained stable in recent weeks, showing only marginal day-to-day movement. Since the beginning of the current fiscal year, it has lost Rs3.37 or 1.20 per cent against the greenback. On a calendar year basis, the rupee is down Rs3.17 or 1.12 per cent so far in 2025.

On the global front, the dollar weakened amid a volatile week dominated by a US-China tariff truce and renewed speculation about Washington’s approach to the dollar’s strength in trade policy. Market chatter intensified after it emerged that officials from South Korea and the US held talks last week on the dollar-won exchange rate.

Although a Bloomberg report suggested these discussions may not indicate a formal push for a weaker dollar, investors remained alert to any signs of a policy shift. This sentiment underpinned gains in Asian currencies, including the won, and contributed to broader dollar softness.

Previous close

Locally, the rupee had ended Wednesday’s session at Rs281.72, down slightly by 4.34 paisa or 0.02 per cent from the previous close of Rs281.67. Throughout the day, the currency moved within a narrow band, with a high of Rs281.75 and a low of Rs281.70. In the open market, exchange companies quoted the dollar at Rs282.51 for buying and Rs283.76 for selling.

In terms of other foreign currencies, the rupee showed a mixed trend. It fell slightly by 0.02 per cent against the Saudi riyal, closing at Rs75.11. Against the Japanese yen, the rupee depreciated by 0.62 per cent to Rs1.9168. It also lost ground to the euro, declining by 0.90 per cent to Rs315.93, and weakened marginally to Rs76.70 against the UAE dirham.

The local unit dropped further to Rs375.42 versus the British pound, a decrease of 0.87 per cent from the previous session. However, the rupee gained 0.16 per cent against the Chinese yuan, settling at Rs39.07. Against the Swiss franc, it depreciated by 0.31 per cent to close at Rs336.18.

With limited domestic triggers and global currency markets reacting to geopolitical and trade developments, the rupee’s near-term direction is likely to remain range-bound, though sensitive to any shifts in US dollar policy.