- Web

- Feb 05, 2026

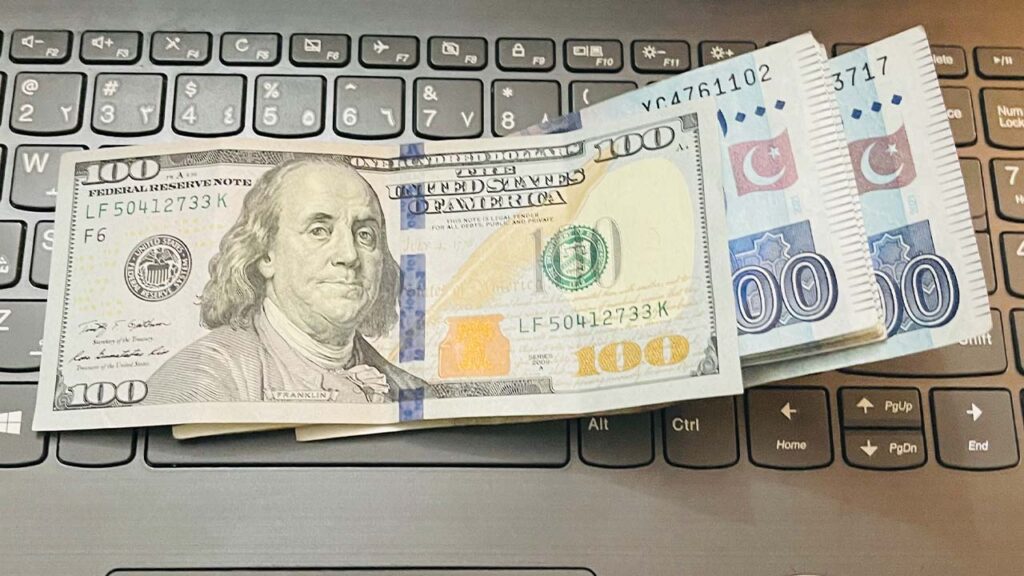

Interbank closing: PKR gains one paisa against USD

-

- Web Desk

- Apr 04, 2024

WEB DESK: The Pakistani rupee (PKR) demonstrated resilience in the inter-bank market on Thursday, maintaining stability against the US dollar (USD).

Closing at 277.93, the local currency experienced a nominal decrease of Re0.01 compared to the previous day’s exchange rate, as reported by the State Bank of Pakistan (SBP).

Yesterday’s slight depreciation follows Wednesday’s marginal loss, where the rupee settled at 277.92 against the USD, as per SBP data.

This stability amidst minor fluctuations echoes the cautious sentiments prevailing in global markets.

Internationally, the US dollar remained under pressure despite recent peaks. Market participants closely observed remarks from Federal Reserve Chair Jerome Powell, interpreting them as supportive of potential interest rate cuts later in the year.

Moreover, anticipation surrounded the release of the latest US labour market data, influencing trading activities.

The unexpected deceleration in US service growth further fueled expectations of rate cuts, thereby weighing on the dollar.

However, despite these dynamics, the US dollar index, which tracks its performance against a basket of major currencies, has maintained its position as the top-performing G10 currency for the year.

This resilience is attributed to more moderate expectations of rate adjustments compared to earlier projections.

Meanwhile, oil prices experienced a marginal uptick on Thursday. Concerns over constrained supply persisted as major producers continued to implement output cuts.

Additionally, signs of robust economic growth in the United States, the world’s largest oil consumer, contributed to the upward momentum.

In the commodities market, Brent futures for June edged up by 4 cents to reach $89.39 per barrel at 0651 GMT. Similarly, US West Texas Intermediate (WTI) futures for May increased by 2 cents, settling at $85.45 per barrel.

The intricate interplay of global economic indicators underscores the cautious optimism prevailing in financial markets, with stakeholders closely monitoring developments for potential implications on currency movements and broader economic trends.