- Web Desk

- Today

Reko Diq, other mining projects boost auto leasing

-

- Syed Raza Hassan

- Apr 21, 2025

Auto leasing is on the rise these upcoming mining projects are expected to increase heavy vehicle sales

KARACHI: After years of slump, the auto financing is rising in Pakistan along with the truck’s sales which is expected to surge with the Reko Diq and other mining projects unveiling in the South Asian country, analysts said on Monday.

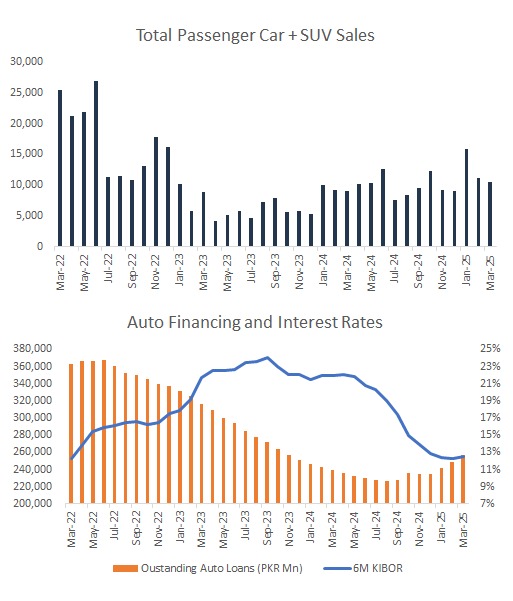

The auto financing in Pakistan has increased to Rs257.36 billion at the end of March, up from Rs248.82 billion in February as buyers increasingly turn to banks for new and used vehicles leasing, according to the State Bank of Pakistan.

Foreign profit repatriation more than doubles to $1.72bn in 9MFY25: SBP report

“There’s a direct correlation between interest rates and auto financing in Pakistan. With interest rates nearly halved from their peak, sales volumes and financing numbers have surged. As inflation trends prompt policymakers to reduce interest rates to single digits, we can anticipate further growth in auto loans,” Mohammad Rizwan, Director at Chase Securities told Hum News English.

Central bank has slashed the policy rate or interest rates by 1,000 bps from an all-time high of 22 per cent in June 2024, to 12 per cent in an attempt to revive economic growth. In the last announcement of the Monetary Committee, the policy rate was kept unchanged at 12 per cent.

A likely slash in policy rate in the upcoming Monetary Committee’s meeting could further boost auto leasing in the country.

The light and heavy transport vehicles segment in Pakistan has recently begun to recover from sales slump from economic slowdown.

“Reko Diq and other mining projects are expected to drive the truck demand in the years to come, the continued implementation of the axle load regime has provided significant support to volumetric sales growth in the past years,” Chase Securities Research stated.

“We believe that this has significantly reduced the capacity of operators in terms of the payload they are able to manage. As a result, we believe that any growth in demand for transport will directly lead to increased sales,” the research report adds.

Financing in the logistics space has low penetration, as larger companies from the formal sector move into the mining sector, the use of financed fleets will be higher, hence monetary easing could lend a positive impact on sales volumes.

Govt seeks Nepra nod to revise power deals, save over Rs1.5 trillion

Early indications of a rebound in demand are visible when looking at the bank’s outstanding credit to freight transport by road segment. The spike of about PKR 4.5 billion in the net outstanding credit is indicative of the sector’s growth and potential for enhancing financing penetration for fleets.

The existing fleet size in the country is insufficient to meet rising demand for both people and goods transport, the Chase Securities Research went on to add.