- Web

- Feb 05, 2026

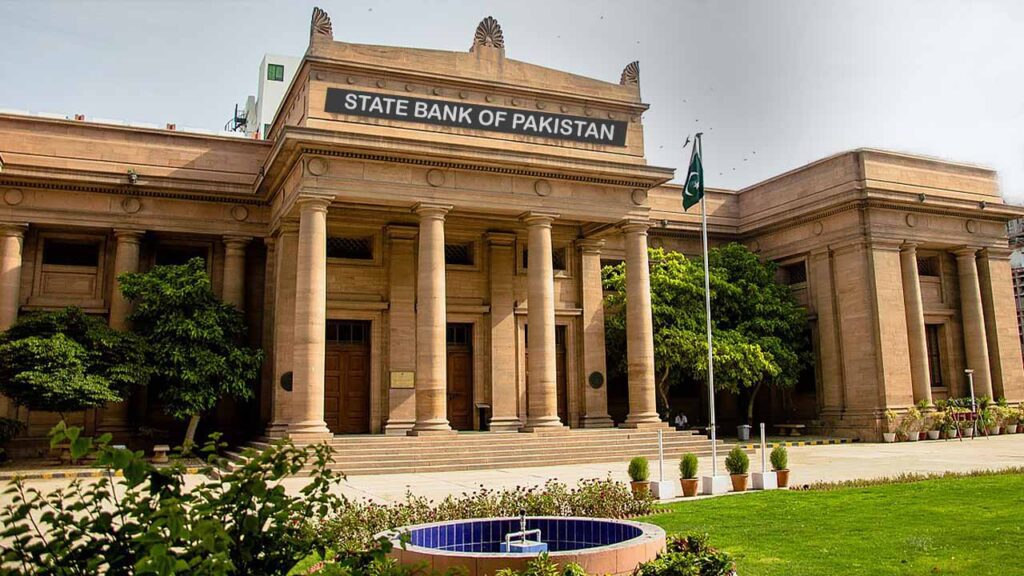

No change expected: SBP likely to maintain 22% interest rate

-

- Web Desk

- Oct 21, 2023

WEB DESK: The State Bank of Pakistan (SBP) is expected to keep its key interest rate steady at 22 per cent this month, according to a recent poll conducted by brokerage Topline Securities.

The survey, which gathered insights from analysts and financial market participants, revealed that 70 per cent of respondents expect the policy rate to remain unchanged, citing easing inflation due to reduced fuel prices and a strengthened rupee as significant contributing factors.

To curb inflationary pressures and bolster the external balance, the SBP has raised its policy rate by a total of 1,500 basis points since October 2021.

However, the rate has been maintained at 22 per cent since July 2023. Analysts from Topline Securities believe that the central bank is likely to hold the rate steady until at least March 2024, signalling a pause in its tightening cycle.

Several positive developments have emerged since the last meeting of the Monetary Policy Committee (MPC) on September 14.

These include a substantial decrease in Pakistan’s current account deficit, dropping from $164 million in August to $8 million in September.

Read more: SBP forex reserves surge to $7.7 billion in a week

Additionally, local fuel prices experienced an average 11 per cent reduction, contributing to the moderation of inflationary pressures.

Furthermore, international oil prices remained stable at around $90 per barrel, and the Pakistani rupee strengthened by 7 per cent against the US dollar.

The upcoming policy review meeting, scheduled for October 30, is expected to address these economic indicators and their potential impact on monetary policy.

Market observers are keenly watching the SBP’s decisions, given the recent positive trends in the country’s economic landscape.