- Web

- Feb 05, 2026

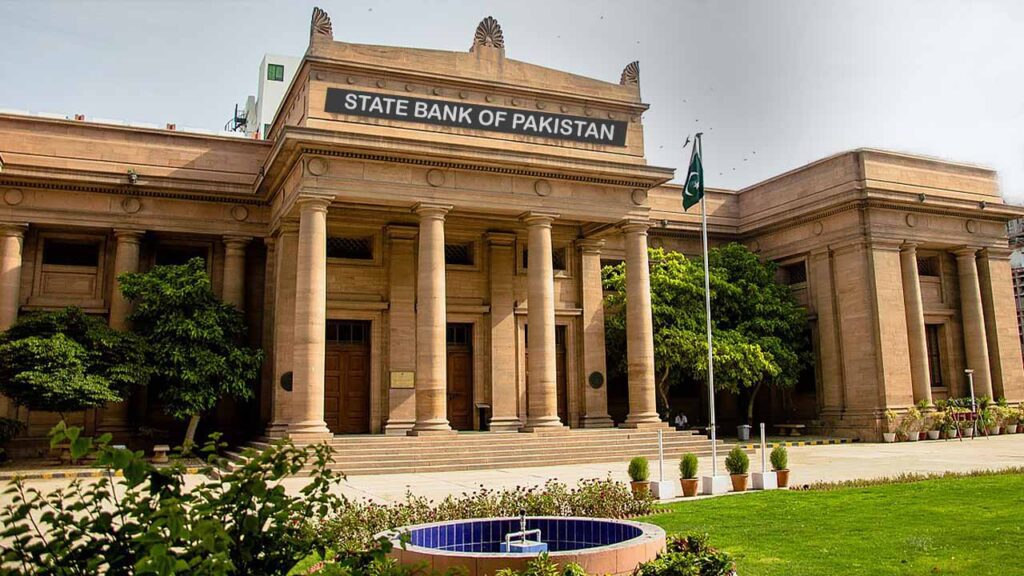

Will SBP lower policy rate following continuous decline in inflation?

-

- Web Desk

- Jun 04, 2024

WEB DESK: Pakistan’s headline inflation rate declined for the fifth consecutive month to 11.8 per cent in May, raising expectations that the State Bank of Pakistan (SBP) may lower its policy rate, according to S&P Global Market Intelligence.

This analysis, provided by S&P Global Market Intelligence highlights key trends and projections. The realised headline Consumer Price Index (CPI) inflation of 11.8 per cent for May was significantly lower than market expectations, primarily driven by a notable deflation in food prices, especially perishables.

Inflation is anticipated to continue its downward trajectory in the coming months, largely due to favourable base effects.

Despite this trend, inflation is expected to remain in the double-digit range, with S&P Global Market Intelligence forecasting an average monthly year-over-year inflation rate of 13.7 per cent for 2024.

In response to the current economic environment, including elevated inflation, global financial market uncertainties, and the upcoming budget announcement in June, the SBP maintained its policy rate at 22 per cent during its meeting on April 29.

However, the recent easing in headline inflation increases the likelihood of the SBP lowering its policy rate in June 2024.

Overall, S&P Global Market Intelligence projects a cumulative reduction of 450 basis points in the policy rate by the end of 2024.

Read next: Digitising tax system crucial for transparent collection: FinMin