- Web

- Feb 05, 2026

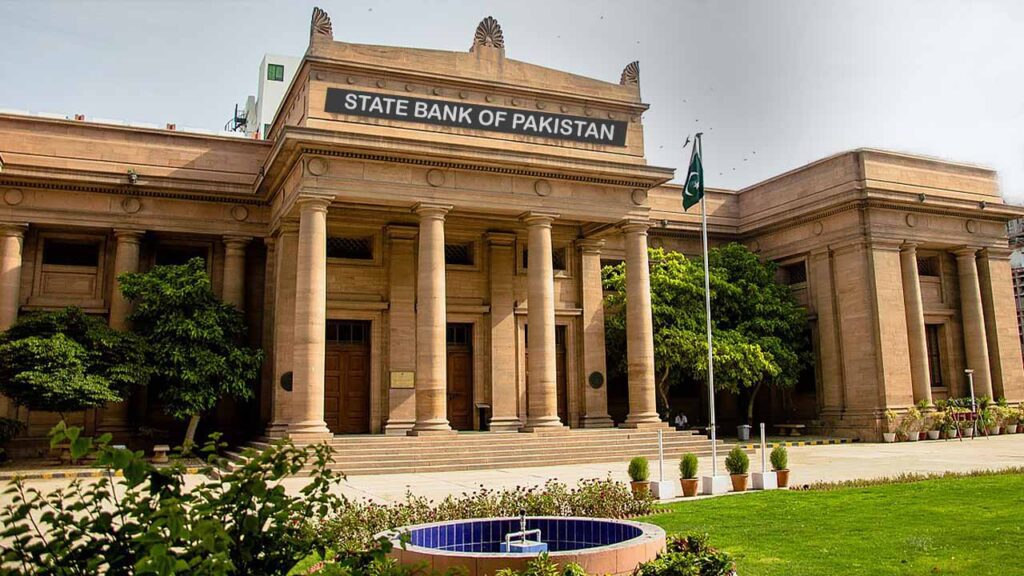

SBP to decide new monetary policy today; inflation, exports in focus

-

- Web Desk

- Mar 18, 2024

KARACHI: Pakistan’s financial landscape is slated to get a new monetary policy today as the central bank’s monetary policy committee (MPC) is all set to convene under the stewardship of State Bank of Pakistan (SBP) Governor Jameel Ahmed.

The MPC will decide on the policy rate that will shape the nation’s economic trajectory over the next two months. The announcement of new interest rate will be communicated via a press release by the SBP outlining the monetary stance for the upcoming two-month period. Presently, the State Bank’s policy rate stands at an all-time high of 22 per cent – a figure that has drawn scrutiny from various quarters of the business community.

SBP’s dilemma: to cut or not to cut interest rates

Ahead of the MPC session, voices within the export sector, alongside representatives from the Federation Chamber of Commerce and Industry and Karachi Chamber of Commerce and Industry, are advocating for a reduction in the interest rate. Their argument hinges on the belief that a lower rate would bolster competitiveness and stimulate economic activity, particularly in the export-oriented industries.

Highlighting the pivotal role of exports in the monetary policy framework, the central bank has affirmed its commitment to closely evaluating export figures in its decision-making process. Moreover, inflationary trends, imports dynamics, and the broader trade and fiscal deficits will also be scrutinised during the meeting.

Stock Market opens with expectations of new monetary policy today

With inflationary pressures looming large, the MPC is expected to assess the current rate of inflation and its potential implications for the economy. Concurrently, matters pertaining to import dynamics will be thoroughly reviewed, said a statement of the SBP ahead of the meeting.