- Web

- Feb 05, 2026

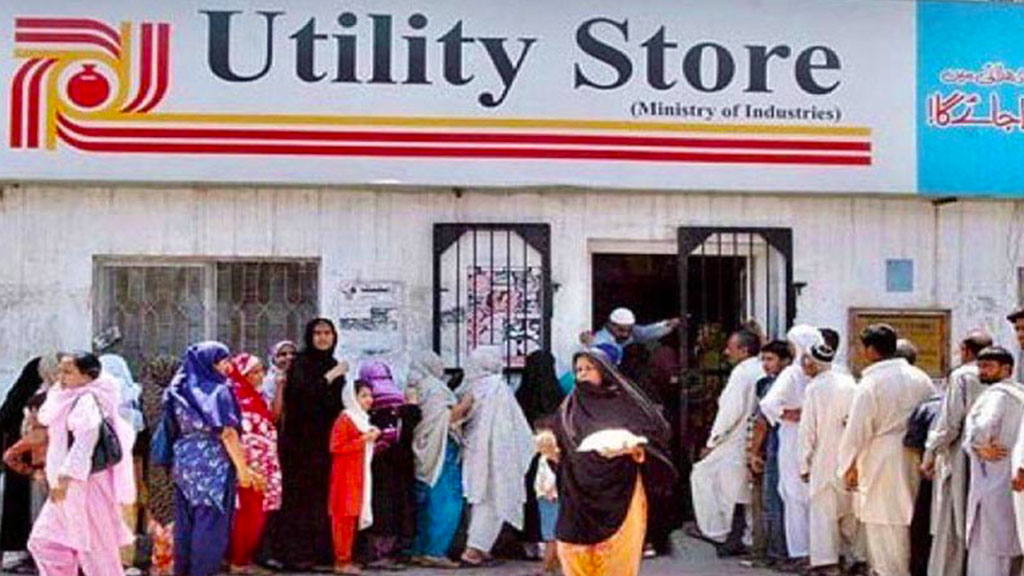

Utility Store Corporation contributes more than Rs5 billion in taxes

-

- Web Desk

- Oct 21, 2023

WEB DESK: The Utility Store Corporation of Pakistan (USC), a non-profit organisation (NPO) operating with government subsidy support, has significantly contributed to the nation’s revenue by paying over Rs5 billion in taxes over a five-month period from 2012 to 2016.

In a recent statement released on Friday, the USC revealed that it had declared input tax payments totaling Rs5,049,948,999 against purchases made during this period.

These details were accurately reflected in the sales tax returns that the corporation filed. The USC shared these details in connection with a complaint it lodged with the Federal Tax Ombudsman (FTO).

The complaint alleges ‘maladministration and misrepresentation’ on the part of the Deputy Commissioner of Inland Revenue (DCIR) at the Large Taxpayer Office (LTO) in Islamabad.

This accusation arises from a pending appeal filed by the USC related to the tax period from 2012 to 2016. The USC, registered as an NPO, operates with a subsidy grant provided by the Pakistani government, aimed at aiding disadvantaged individuals.

Read more: SBP likely to maintain 22% interest rate

The corporation is engaged in the sale of essential household items and grocery products, including flour, sugar, pulses, tea, rice, and more.

According to the USC’s complaint, these claims about their tax payments are entirely verifiable through the FBR e-portal computerised system.

The relevant purchase details were duly provided to the department during various proceedings.

However, the complaint asserts that an additional tax amount was arbitrarily imposed without proper verification from the FBR system through O.N.O. No. 05/51 dated February 28, 2019.