- Web

- Feb 05, 2026

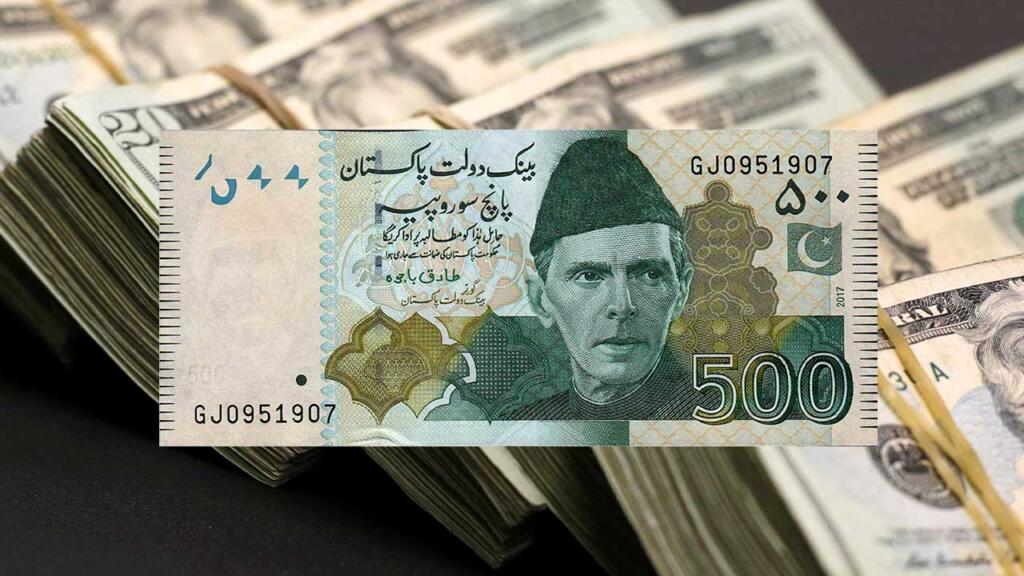

Interbank closing: Pakistani rupee loses 6.31 paisa against US dollar

-

- Web Desk

- Feb 15, 2024

WEB DESK: In the latest interbank session, the Pakistani rupee (PKR) witnessed a slight depreciation of 6.31 paisa against the US dollar (USD), settling at PKR 279.38 per USD.

This contrasts with the previous session’s closing rate of PKR 279.32 per USD. The currency demonstrated an intraday high (bid) of 279.65 and a low (ask) of 279.45.

Interbank closing #ExchangeRate for today https://t.co/5KeIpoJvJg#SBPExchangeRate pic.twitter.com/N3JE0i7Ywk

— SBP (@StateBank_Pak) February 15, 2024

Meanwhile, in the open market, exchange companies quoted the buying rate for the dollar at 279.14 and the selling rate at 281.59.

As financial markets navigated the aftermath of last week’s elections, which herald the arrival of a new government, the PKR faced fluctuations against major currencies.

Against the Euro, it lost 94.76 paisa, closing at 299.86 compared to the previous value of 298.91. The British Pound experienced a marginal increase of 5.12 paisa, closing at 350.51 compared to 350.46 from the previous day.

The Swiss Franc gained 1.35 rupees, closing at 315.93, while the Japanese Yen saw a decline of 0.56 paisa, closing at 1.861 against the previous day’s 1.8554.

The Chinese Yuan edged up by 0.88 paisa, closing at 38.84 compared to 38.83 in the previous session.

Furthermore, the Saudi Riyal closed at 74.49, registering a gain of 1.69 paisa from its value of 74.48 a day ago. Similarly, the UAE dirham increased in value by 1.61 paisa, rising from 76.07 to 76.05.

Analysing the performance during the current financial year, the PKR has appreciated against the dollar by 6.61 rupees, or 2.37 per cent. In the calendar year, PKR has seen an appreciation of 2.48 rupees, or 0.89 per cent.

Shifting focus to the money market, the benchmark 6-month Karachi interbank bid and offer rates experienced a marginal increase of 1 bps, reaching 21.19 per cent and 21.44 per cent, respectively.

It’s noteworthy that in the PIB auction conducted by the central bank, yields recorded an increase of up to 5 bps.

This change follows the central bank’s decision to maintain the interest rate at 22 per cent for the fifth consecutive meeting held on January 29, 2024.

Read next: PSX loses over 1,100 points