- Web

- Feb 05, 2026

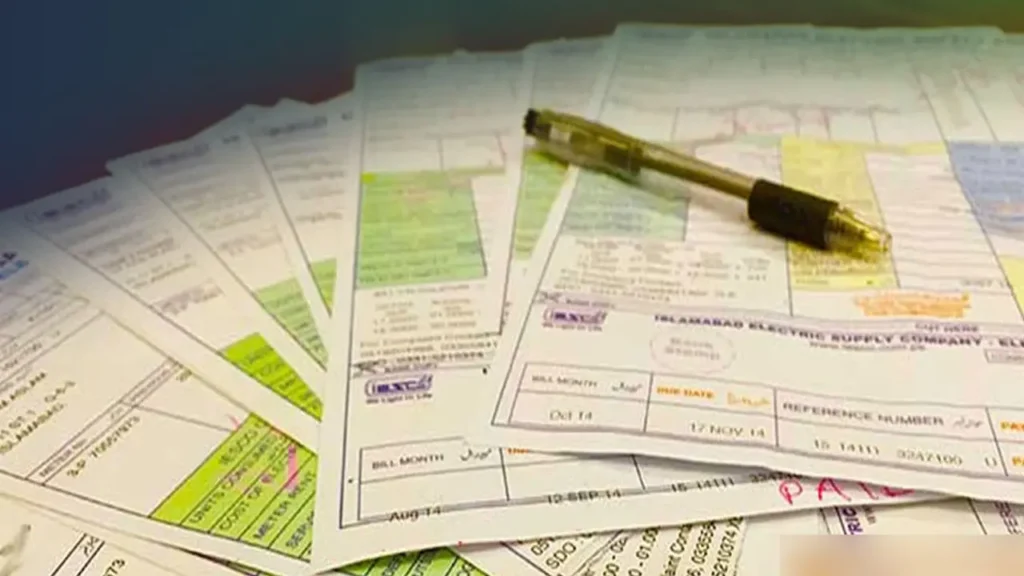

Govt to roll out QR codes on utility bills under digital payment push

-

- Web Desk

- Jul 28, 2025

ISLAMABAD: The federal government has decided that all electricity, gas and telephone bills will soon carry printed QR codes to allow digital payments.

The decision was made at a high-level meeting chaired by Prime Minister Shehbaz Sharif and attended by officials from relevant ministries and departments. The move is part of broader efforts to boost Pakistan’s digital transformation, according to officials.

As part of the plan, the prime minister is expected to launch the Digital Payment Index Pakistan next month. The State Bank of Pakistan (SBP) Governor and the CEO of Karandaaz have been asked to make the necessary arrangements.

To ensure smooth rollout, a committee led by the Secretary Petroleum and Natural Resources will prepare an implementation framework within a month. The group will also include the Secretary Power, Secretary Information Technology and Telecommunications, and the Chairman of the Capital Development Authority (CDA).

QR codes to be made mandatory at fuel stations

A separate mechanism will be drawn up by the Secretary Petroleum and the Chairman of the Oil and Gas Regulatory Authority (OGRA). This will ensure that all petrol stations in Pakistan, including those in Gilgit-Baltistan and Azad Jammu and Kashmir, have QR codes, Point of Sale (PoS) terminals or soft PoS systems. These payment tools will become a condition for licence approval.

The Chairman CDA, in consultation with the Law and Justice Division, has been asked to review existing laws to support the mandatory use of QR codes and other digital payment systems.

New targets set for digital payments

The State Bank has been given fresh goals to help increase the use of digital payments. These include:

- Expanding QR code payment points from 0.5 million to 2 million

- Ensuring each active merchant completes at least one digital transaction per month

- Increasing mobile and internet banking users from 95 million to 120 million by FY26

- Raising the number of digital transactions to 15 billion from 7.5 billion

- Making 100 per cent of remittances digital, compared to the current 80 per cent

To support this, the Finance Ministry and SBP have been directed to revise the annual subsidy limit for promoting cashless payments to Rs3.5 billion. This includes a 0.5 per cent incentive for banks that onboard merchants on the Raast platform. Banks may charge merchants up to 0.25 per cent as a Merchant Discount Rate (MDR), with any extra cost to be covered by service providers.

Committees to finalise timelines and appointments

The Government Payment Sub-Committee has been asked to review its proposed timelines in consultation with provinces and other stakeholders. Revised targets for State-Owned Entities and Person-to-Government (P2G) payments, shortened by at least one-fourth, will be shared at the next meeting.

The SBP Governor has also been directed to ensure that private sector board members of Raast Payment Pakistan are experienced experts in digital finance. The appointment of the organisation’s CEO must be finalised by the end of September 2025.

Read next: Gold dips to two-week low as US-EU trade deal eases market anxiety