- Web

- 28 Minutes ago

Andrew Tate liquidated: loses $112,000 in crypto

-

- Web Desk

- Nov 19, 2025

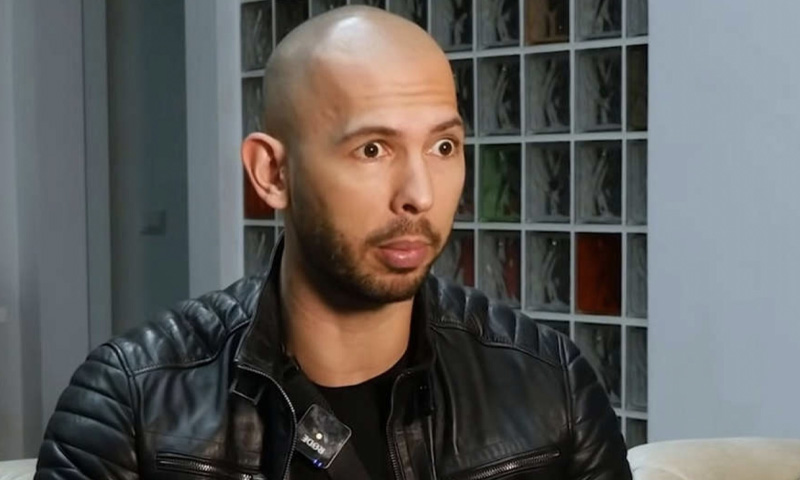

Andrew Tate, the controversial internet personality, has been dubbed “one of the worst traders in crypto” after losing $112,000 on the decentralised exchange Hyperliquid. According to an article published in BeInCrypto, Tate’s trading history has been marked by a string of liquidations and substantial losses, despite his repeated high-leverage bets. His most recent loss as well as his trading practices have sparked criticism from analysts and traders alike.

Tate’s downfall follows a familiar pattern seen across the crypto space which is in essence a high-stakes game of leveraged trading gone wrong. His latest loss comes after his Bitcoin long position was liquidated for a staggering $112,000 on November 18, leaving his account balance at a mere $984. This liquidation was the latest in a series of failed trades that have eroded his initial deposit of $727,000 on the platform.

Blockchain analytics from Arkham reveal that Tate initially deposited $727,000 into Hyperliquid, a decentralised perpetual exchange. However, that money quickly became locked in a series of ill-timed trades that ended in full liquidation. In a bid to recoup his losses, Tate turned to referral bonuses, using $75,000 earned from users joining the platform through his link to fund further trades. This, too, ended in failure, with the entire $75,000 wiped out in a fresh round of liquidations.

Tate’s record on Hyperliquid shows a clear trend of poor decision-making. According to analysts, his win rate stands at a mere 35.5 per cent, with a cumulative loss of $699,000 over a few months. His largest single loss occurred in June 2025, when he lost $597,000, but that was only the beginning of a downward spiral.

Despite the occasional small win, such as the $16,000 profit from a short position on YZY in August, Tate’s trading strategy has been consistently characterised by high-risk, high-reward bets that more often than not lead to painful liquidations.

A CAUTIONARY TALE FOR CRYPTO ENTHUSIASTS

Analysts have been quick to criticise Tate’s approach to crypto trading, calling his strategy reckless and indicative of a larger trend among traders who fail to manage the risks of high-leverage positions. One observer remarked, “Based on his trading record, Andrew Tate might be one of the worst traders in crypto. And yet, people still pay him for advice.”

The rise of decentralised exchanges like Hyperliquid has opened the door to massive profits but also exposes traders to significant risks. For those like Tate, who have openly embraced high-leverage trading, the rapid liquidations serve as a harsh reminder of just how quickly fortunes can be lost.

Despite the criticism, Tate remains a vocal figure in the crypto space, using his platform to promote his approach to trading. However, his ongoing failures suggest that those following his advice may want to reconsider their strategies.