- Web Desk

- Feb 19, 2026

PIA bidding: Arif Habib emerges as front-runner in second round

-

- Web Desk

- Dec 23, 2025

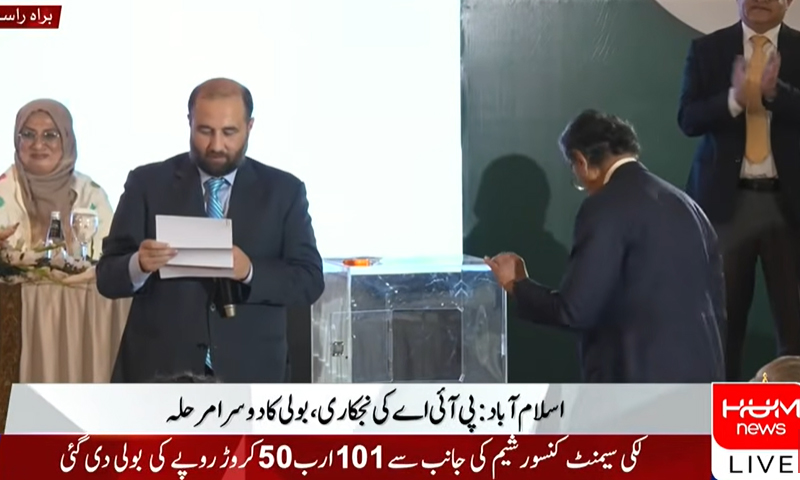

ISLAMABAD: In the second round of bidding for the privatisation of Pakistan International Airlines (PIA), the Lucky Cement‑led consortium submitted an offer of Rs120.25 billion, while the Arif Habib‑led consortium topped the round with a bid of Rs121 billion for the national carrier.

This follows the first televised phase earlier in the day, when sealed bids were opened publicly, marking a renewed and competitive interest in one of Pakistan’s most closely watched privatisation processes. In the initial round, Arif Habib’s group had led with a Rs115 billion offer, followed by Lucky Cement’s Rs101.5 billion bid.

After the second round, a 30-minute break was called on the request of the Lucky Consortium before the continuation of the bidding process.

The second round comes as part of the government’s broader push — backed by economic reforms demanded by the International Monetary Fund — to privatise loss‑making state‑owned enterprises and attract fresh investment into the aviation sector. Improved investor confidence has been attributed to PIA’s stronger financial performance and revival of lucrative European routes.

Under the transaction structure, the government is offering up to 100 per cent ownership of PIA, with a premium applicable for stakes exceeding 75 per cent. The bidding process is being held transparently, with live broadcasts of key moments to bolster public trust.

The next steps will determine the successful bidder who will potentially take control of the national airline in what could be one of Pakistan’s most significant privatisation deals in recent history

The Arif Habib-led consortium includes Fatima Fertilizer, City School, and Lake City Holdings.

The other consortium, led by Lucky Cement and including Hub Power, Kohat Cement, and Metro Ventures, placed a bid of Rs115 billion in the second round. Private airline Air Blue also submitted a bid of Rs26.5 billion.

Chairman of the Privatisation Commission, Muhammad Ali, said the process is part of the government’s policy to open new investment avenues. “Two consortiums have expressed interest in acquiring 100 per cent and 75 per cent of the shares,” he added.

This marks the second attempt by the current government to privatise PIA. Last year, the process failed when only one bid of Rs10 billion was submitted against a reserve price of Rs85 billion.

Currently, the government holds approximately 96 per cent of PIA, which has historically been a loss-making entity under state ownership. Analysts note that the sale is expected to relieve the national exchequer from annual losses incurred in running the airline.

Under the privatisation framework, 75 per cent of PIA’s shares will be sold initially, with the successful bidder given the option to acquire the remaining 25 per cent within 90 days. Two-thirds of the proceeds from the 75 per cent stake must be paid within 90 days, with the balance payable over a year. Of the total proceeds, the government will directly receive only 7.5 per cent, while the remainder will be reinvested in PIA to improve its fleet and operational performance.

Experts say the privatisation could prevent billions of rupees in annual losses that the government had been covering for PIA. The airline’s market value has improved, with equity moving from a negative Rs45 billion last year to Rs30 billion following the transfer of liabilities. The successful bidder will also benefit from exemptions on an 18 per cent general sales tax on aircraft leases, and certain tax liabilities will be transferred to the holding company.

The next phase of open bidding between Arif Habib Group and the Lucky Cement consortium will determine the new owner of Pakistan’s national airline.

What Will Happen to PIA Employees and Assets After Privatisation?

As Pakistan International Airlines (PIA) moves closer to privatisation, questions have emerged about the future of its employees and assets.

Currently, PIA operates a fleet of 38 aircraft, of which only 18 are operational. The airline has landing rights at 78 airports worldwide, including major European cities such as London. PIA also flies to Canada, but flights to the United States remain suspended.

According to the Privatisation Adviser, the number of PIA employees has decreased significantly over the past six to seven years—from around 11,500 to roughly 6,500. Employees will retain job security for one year after privatisation. During this period, they will continue to receive salaries and other benefits. After the one-year period, there is no indication of mass layoffs, though voluntary separations may be requested. Retired employees’ pensions, medical bills, and concessionary tickets will continue to be paid by PIA Holding Company.

PIA also owns valuable real estate, including the Roosevelt and Scribe hotels in New York and Paris. However, these properties will not be part of the privatisation deal. Only operational, cargo, passenger, kitchen, and training-related assets are included in the transaction.

From Losses to Profits: How PIA Turned Around

According to 2024 reports, PIA posted an operational profit of Rs9.3 billion and a net profit of Rs26.2 billion. This is a remarkable turnaround from 2023, when the airline suffered a net loss of Rs75 billion. The airline’s operating margin exceeded 12 per cent, matching the performance of top global carriers. Operational costs included fuel, administrative expenses, and distribution costs.

PIA credited its improved performance to comprehensive reforms under government supervision. These included workforce and cost reductions, stabilisation of profitable routes, elimination of loss-making routes, and restructuring of the balance sheet. Officials say this will not only enhance PIA’s credibility but also benefit the national economy.

Bloomberg noted that the airline’s first net profit in 21 years was possible only after a significant portion of its debt was transferred to government accounts. Audited financial statements indicate that PIA earned Rs5.01 per share in the fiscal year ending December 2024.

During a November 2024 National Assembly committee briefing, the Privatisation Secretary revealed that prospective bidders requested the government to waive Rs26 billion in tax liabilities, Rs10 billion in interim financial support from the Civil Aviation Authority, and Rs9 billion in other dues.

Experts say that PIA’s net profits were made feasible because the government assumed responsibility for hundreds of billions of rupees in loans and interest payments, effectively “cleaning” the airline’s balance sheet and making it profitable. Former Finance Minister Miftah Ismail confirmed that PIA’s debt of Rs850 billion was largely taken over by the government, making operational profitability achievable.