- Web Desk

- Feb 24, 2026

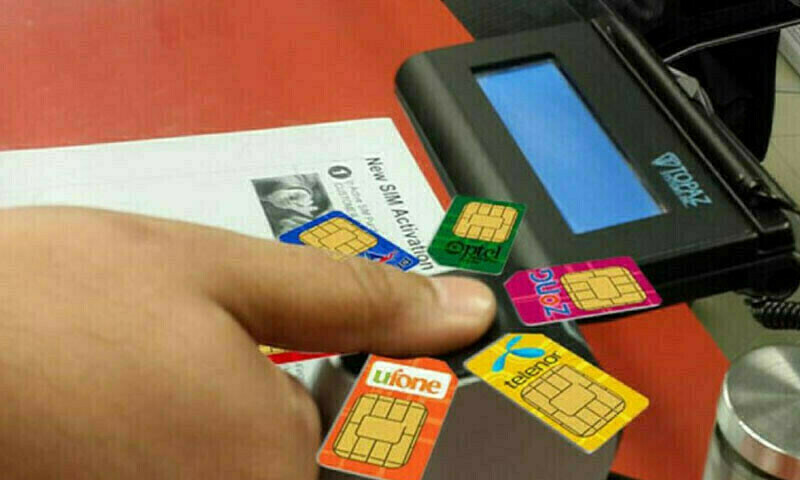

FBR forms joint working group to block SIMs of non-filers

-

- Web Desk

- May 17, 2024

ISLAMABAD: The Federal Board of Revenue (FBR) has formed an 18-member joint working group to block the SIMs of non-tax filers.

According to sources, the FBR has issued a notification for the formation of the joint working group consisting representatives from FBR, Pakistan Telecommunication Authority (PTA), and mobile phone operators including Jazz, Ufone and Telenor.

FBR stated that the working group will ensure the implementation of the Income Tax General Order and will remove obstacles in blocking the SIMs of non-filers.

Earlier today, during a hearing on a petition against the stay order to stop action against a private telecommunication company for failing to block SIMs, Islamabad High Court Chief Justice Aamer Farooq remarked that he had stopped the authorities from talking action against the company, not the blocking of SIMs. Justice Aamer Farooq requested the media to report that the previous order was not as it had been reported.

The judge said that he did not stop the blocking of SIMs but it was related to not taking action against the private cellular company.

Earlier, the FBR had ordered to block the SIMs of non-tax filers under the Income Tax General Order (ITGO) through a letter sent to the PTA, stating that the SIMs of 506,671 individuals who failed to submit their returns for the tax year 2023 should be blocked.

The FBR had begun compiling the final list of non-filers who were eligible for income tax but did not pay, as part of measures to expand the tax net under the demands of the International Monetary Fund (IMF).

However, later on, telecom companies sent joint reservations to the Ministry of Information Technology against FBR’s decision to block the SIMs of non-filers, stating that the decision was made hastily and would have negative effects on telecom consumers.

Cellular mobile operators (CMO) stated in their letter that they were obligated to provide uninterrupted services to their customers, except under the conditions stated in the Telecom Act and applicable regulations. There is no precedent where a CMO can disconnect or block a customer’s services, they said.

The letter explained that implementing the Income Tax General Order hastily will negatively impact consumers and severely affect their ability to obtain essential services.

Also read: Telecom operators block over 3,500 SIM cards on FBR’s direction

According to the letter, consumer protection was important, and the regulations for consumer protection require operators to suspend services only with prior notice of such intentions, and immediate issuance of notice was not possible due to legal flaws in the Income Tax General Order.

The letter further stated that if telecom operators comply with the ITGO, affected individuals can take legal action against the cellular mobile operators.

According to the letter, the affected individual may also attempt to recover special expenses and damages incurred due to the blocking of the SIM card, which was unreasonable and unacceptable for CMOs.

It further stated that telecom companies were one of the largest revenue contributors in the country, and before enforcing such orders, it was necessary to provide CMOs with some protections or compensation through amendments in the law to prevent negative outcomes or claims from consumers.

The telecom industry had also said that blocking a large number of SIMs will technically be problematic, and if required by law, CMOs will need to warn such consumers several times via SMS before blocking them because they were obligated to provide their consumers with prior legal notice with valid reasons, which was absent in this case.

The letter further said that telecom companies need to promote the development of internal processes and systems, which require adequate time and resources, making immediate compliance with such Income Tax General Orders difficult.

The telecom industry also suggested that every individual was entitled to fair and equal treatment with due process under the law, hence individuals affected by the Income Tax General Order should be formally informed through a broad media campaign and provided with show-cause notices so that they can present their case in a tribunal or court.

Later, the PTA had excused FRB for blocking over 500,000 SIMs stating that legally PTA was not obligated to block SIMs.

PTA clarified in the response letter to FBR that the process of blocking SIMS of non-filers “does not align with our system because a large number of women and children use SIMs registered in men’s names.”

On May 10, details for blocking SIMS of 5,000 non-tax filers were provided to telecom operators, after which they began sending messages warning non-filers about the blocking of their SIMs.