- Web Desk

- Feb 24, 2026

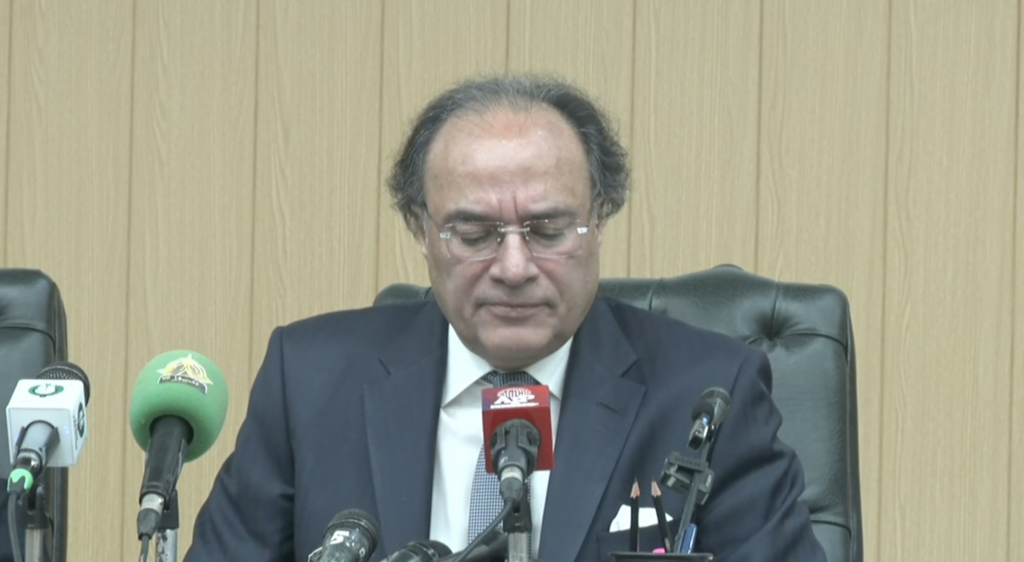

Govt mulling tax reforms to achieve 13.5pc tax to GDP ratio: Aurangzeb

-

- Web Desk

- Dec 26, 2024

ISLAMABAD: “The country’s economy is moving towards improvement,” Finance Minister Muhammad Aurangzeb said during a press conference, here on Thursday. Flocked by the Federal Board of Revenue (FBR) Chairman Rashid Langrial, and the Minister of State for Finance Ali Pervaiz Malik, the Finance Minster also announced that the government has initiated structural tax reforms.

Aurangzeb said that the reforms are aimed at achieving the target of 13.5 per cent tax to GDP ratio.” “Current tax to GDP ratio is 9 to 10 per cent,” Aurangzeb said, adding that the government is also taking steps to curb inflation.

He said that the economy will move towards improvement if we incorporate more technology. “The tax bill presented in the Parliament is also related to technology,” the Finance Minister said, adding that the government is striving to achieve revenue targets.

“We have to achieve tax-related targets in three years,” he said, adding that transparency in the modern era digitisation is of great importance when it comes to tax and overall economy targets.

Federal Minister for Information and Broadcasting, Attaullah Tarrar was also present during the press conference.

More than 38,000 people have tax amounting to Rs370 million

FBR Chairman Rashid Langrial

Addressing the press conference alongside Finance Minister, Langrial pointed out that at least 2.7 million Pakistanis are not filing their tax returns which adds immense burden on the economy. He said that all citizens must fulfil their responsibilities instead of tax evasion.

“The capacity of the FBR is being increased, and we are introducing modern tools. Our focus is on the top five per cent regarding tax collection, and more than 38,000 people have paid tax equivalent to Rs 370 million,” he said.

The total tax gap in the country is Rs7.1 trillion, FBR chairman said, adding that the board has issued notices to 169,000 people out of 190,000.

“[Only] 38,000 out of these 190,000 people filed taxes,” Langrial said, adding, “Out of 3.3 million people in the top 5 per cent income category, only 600,000 people file taxes.”

He informed that all institutions concerned are working together with the FBR. Faceless assessment system has been implemented in Karachi, which also accounts for over 80 per cent of the country’s exports. “Faceless assessment has eliminated human intervention. This system was implemented from December 15, and is fully operational.

The government and Pakistan Revenue Automation Limited (PRAL) are working together for digitalisation. The Prime Minister has also approved a new board of directors for PRAL, FBR Chairman said while reiterating the need to take invoicing towards digitisation.

“Along with invoicing, monitoring of some units is also necessary,” he said. Two sensors have been installed in the sugar industry. “Counting has become very easy with new technology,” FBR Chairman said.

There are strict instructions from the prime minister for the sugar sector. “They are taking help from the Intelligence Bureau for the sugar sector,” FBR Chairman said.

Inflation has come down from 40 per cent to 5 per cent, but everyone needs to shoulder their fair share of taxes.

State Minister Ali Pervaiz Malik

The country’s economy is moving towards improvement under the leadership of the Prime Minister, Minister for State for Finance Ali Pervaiz Malik said, adding, “Steps are necessary to improve the purchasing power of the common man.”

He said that while inflation has come down from 40 per cent to 5 per cent, everyone will need to shoulder their fair share of taxes. Malik said that work is being done to improve the quality of taxes through digitisation.

Finance Minister Aurangzeb added that important steps will be taken to review inflation. “Inflation has been included in the agenda of the Economic Coordination Committee (ECC) of the Cabinet,” he said, adding that the prices of various items will also be reviewed in every meeting of the ECC.

The ratio of the global market and the prices here will be compared, Finance Minister said.