- Web Desk

- 8 Hours ago

KP unveils over Rs1,700 billion ‘surplus’ budget

-

- Web Desk

- May 24, 2024

PESHAWAR: The Khyber Pakhtunkhwa government on Friday unveiled a ‘Rs100 billion surplus’ budget for the fiscal year 2024-25.

The budget session began with a delay of 2 hours and 15 minutes and was presided over by Speaker Babar Saleem Swati.

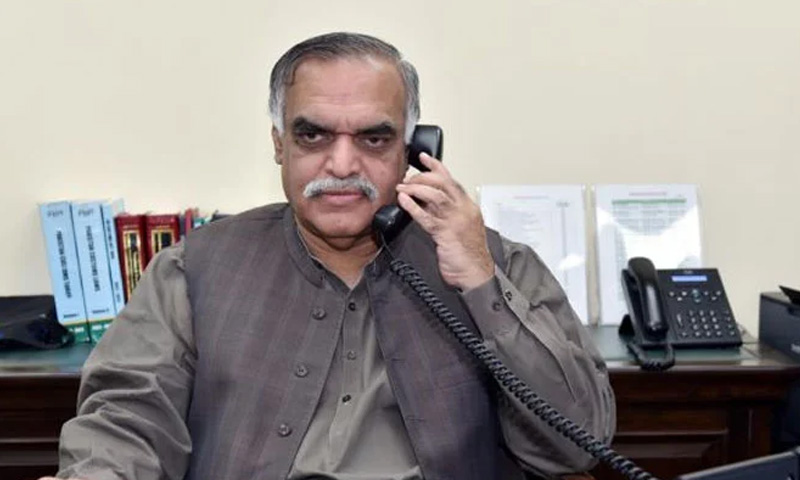

Khyber Pakhtunkhwa’s Finance Minister, Aftab Alam, presented the budget in the presence of Chief Minister Ali Amin Gandapur.

Finance Minister Aftab Alam announced that the total revenue was estimated at Rs1,754 billion, while total expenditures amounted to Rs1,654 billion, with a Rs100 billion surplus.

According to the finance minister, Rs362.68 billion have been allocated for education, which is a 13 per cent increase from the previous year. Out of this, Rs35.82 billion have been allocated for higher education.

The finance minister revealed plans to establish 30 degree colleges in rented buildings. He said that federal tax revenues were estimated at Rs902.51 billion and Rs108.44 billion were expected to be received from the divisible pool’s 1 per cent for the war on terror. Direct transfers for oil and gas royalties and surcharges amount to Rs42.96 billion. The windfall levy on oil stands at Rs46.83 billion and net hydel profit revenues for the “current year” were estimated at Rs33.10 billion.

Aftab Alam added that net hydel profit arrears were expected at Rs78.21 billion, bringing the total revenues to Rs1,212.40 billion.

Under the NFC Award, he said, the annual share for merged districts has been Rs262 billion. Out of this, the province received only Rs123 billion, leading to an annual deficit of Rs139 billion. Each year, the province receives less than its due share, he said.

The finance minister announced a 6 per cent sales tax rate for hotels, and the restaurant invoice management system has been made mandatory for all hotels.

He proposed a fixed sales tax rate for wedding halls and significant relief in property tax. The property tax for factories has been proposed at Rs2.5 per square foot, which is suggested to be reduced to 10,000 rupees per kanal from Rs10,600 per kanal

The finance minister stated that the revenue mobilisation plan targets Rs93.50 billion, with a focus on expanding the tax net. Several reformative measures have been proposed to be taken in taxation.

He proposed reducing the tax on commercial property from 16 per cent of the monthly rent to 10 per cent and lowering the tax on health-related businesses from 16 per cent to 5 per cent.

Due to heavy federal taxes, he said people use stamp paper for property transfers. The provincial taxes on property transfers have been proposed to be reduced from 6.5 per cent to 3.5 per cent, providing a 3 per cent tax relief on property transfers for the public, he said.