- Web

- Feb 20, 2026

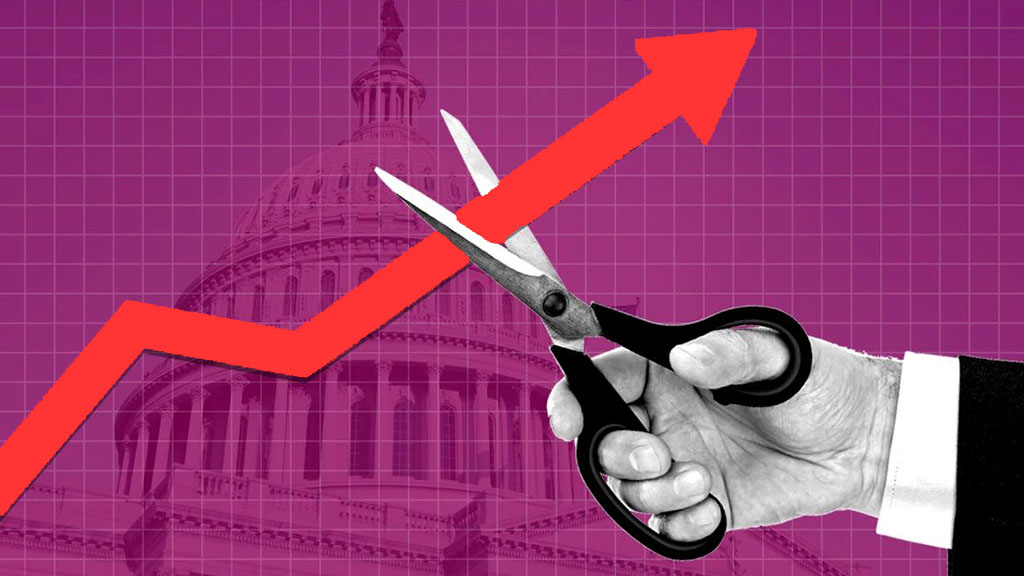

Investors eye US payroll data amid Fed rate cut speculation

-

- Reuters

- Dec 06, 2024

REUTERS: Investors on Friday awaited US payrolls data to see if it challenged or cemented expectations of a Federal Reserve rate cut this month, while the euro stumbled towards a flat week versus the dollar as France was gripped by political turmoil.

European stocks edged up 0.3 per cent after the market opened, while Britain’s FTSE 100 was broadly flat, weighed down by a 0.6 per cent dip for insurer Aviva (AV.L) after it said it was set to buy rival Direct Line in a 3.6 billion pound ($4.6 billion) deal.

Investors were training their sights on the crucial US payrolls report due later in the day. US stock futures were broadly flat ahead of Wall Street’s open.

Forecasts are centred on a rise of 200,000 jobs in November, rebounding from a soft 12,000 gain in October when the result was impacted by hurricanes and strikes. Futures markets put a 67 per cent chance on a rate cut by the Fed on December 18.

“It’s going to be very closely watched … If we don’t get a big surprise around that jobs number, I think the market will pretty much take the fact that the Fed will cut again in its meeting,” said Shaneel Ramjee, senior investment manager at Pictet.

The Aviva swoop on Direct Line in Britain was further evidence of a pick-up in dealmaking across markets, Ramjee added. “Throughout both Europe and the US, these deals are starting to get done, and that just means more activity in the economy,” he said.

In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan reversed earlier losses to be up 0.2 per cent thanks to a rally in Chinese shares, making up for investor caution around political ructions in South Korea.

Chinese shares had climbed to three-week highs as investors scooped up technology shares ahead of a top-level policy meeting next week that will set the agenda and targets for China’s economy next year.

The risk premium investors demand to hold French debt rather than German Bunds dropped to a new two-week low on Friday after President Emmanuel Macron said he would appoint a new prime minister soon to get a 2025 budget approved by parliament.

The euro had rallied on Thursday, on market relief that France had avoided a more volatile political outcome for now. The euro dipped 0.2 per cent on the day at $1.057275 and was set to be broadly unchanged on the week.

Read next: Oil prices dip as OPEC+ delays supply increases amid weak demand