- Web

- 7 Hours ago

US tariffs to hit India from Wednesday, impacting $87bn exports

MUMBAI/NEW DELHI: Indian exporters are bracing for a sharp decline in US orders after trade talks collapsed and Washington confirmed steep new tariffs on the South Asian nation’s goods take effect from Wednesday, escalating tension between the strategic partners.

An additional 25 per cent duty announced by President Donald Trump, confirmed in a notice by the Homeland Security Department, takes total tariffs to as much as 50 per cent, among Washington’s highest, in retaliation for New Delhi’s increased buying of Russian oil.

Read more: India gets another 25pc US tariff over Russian oil purchases

“The government has no hope for any immediate relief or delay in US tariffs,” said a commerce ministry official, who sought anonymity for lack of authorisation to speak to media.

Exporters hit by tariffs would receive financial assistance and be encouraged to diversify to alternative markets such as China, Latin America and the Middle East, the official added.

However, the commerce ministry did not immediately respond to an email seeking comment on the latest notice.

RUPEE DOWN

The new duties will apply from 12:01am EDT on Wednesday (9:31am IST), it showed. Exceptions are shipments in transit, humanitarian aid, and items under reciprocal trade programmes.

Meanwhile, the Indian rupee fell to a three-week closing low of 87.68 against the dollar, despite recovering some ground after suspected central bank intervention to support it.

The benchmark equity indexes and closed down 1 per cent each, for their worst sessions in three months.

Wednesday’s tariff move follows five rounds of failed talks, during which Indian officials had signalled optimism that tariffs could be capped at 15 per cent.

Officials on both sides blamed political misjudgment and missed signals for the breakdown in talks between the world’s biggest and fifth-largest economies, whose two-way trade is worth more than $190 billion.

White House trade adviser Peter Navarro and US Treasury Secretary Scott Bessent have accused India of indirectly funding Russia’s war against Ukraine by boosting Russian oil purchases.

Read more: US Treasury chief Bessent accuses India of profiteering on Russian oil purchases

This month Bessent said India was profiteering from its sharply increased imports, making up 42 per cent of total oil purchases, versus less than 1 per cent before the war, in a shift Washington has called unacceptable.

India has issued no directive yet on oil purchases from Russia. Companies will continue to buy oil on the basis of economics, three refining sources said.

EXPORTERS SEEK AID

Exporter groups estimate hikes could affect nearly 55 per cent of India’s merchandise exports worth $87 billion to the United States, while benefiting competitors such as Bangladesh, China and Vietnam.

Read more: Trump says India is a ‘dead economy’, Rahul agrees

“The US customers have already stopped new orders,” said Pankaj Chadha, president of the Engineering Exports Promotion Council. “With these additional tariffs, the exports could come down by 20 per cent to 30 per cent from September onward.”

The government has promised financial aid such as greater subsidies on bank loans and support for diversification in the event of financial losses, Chadha added.

“However, exporters see limited scope for diversifying to other markets or selling in the domestic market.”

The commerce ministry official said the government had identified nearly 50 countries to which India could boost exports, particularly items such as textiles, food processed items, leather goods and marine products.

India’s diamond industry exports have already hit a two-decade low on weak Chinese demand, and the higher tariffs now threaten to cut it off from its largest market, taking nearly a third of $28.5-billion annual shipments of gems and jewellery.

BROADER ECONOMIC IMPACT

Private sector analysts warn that a sustained 50 per cent tariff could weigh on India’s economy and corporate profits, prompting the steepest earnings downgrades in Asia, even if proposed domestic tax cuts partly cushion the blow.

Read more: US probe into Adani means Modi can’t resist Trump: Rahul

Last week, Capital Economics said full US tariffs would chip 0.8 percentage points from India’s economic growth both this year and the next.

Foreign Minister S. Jaishankar also said trade talks continued and Washington’s concern over Russian oil purchases was not equally applied to other major buyers such as China and the European Union.

The United States could be a major energy supplier to India, an official of its New Delhi embassy said on Tuesday.

At the same time, the official added the United States is committed to collaborate with India on exports of high-quality products and services to help achieve energy security and economic growth.

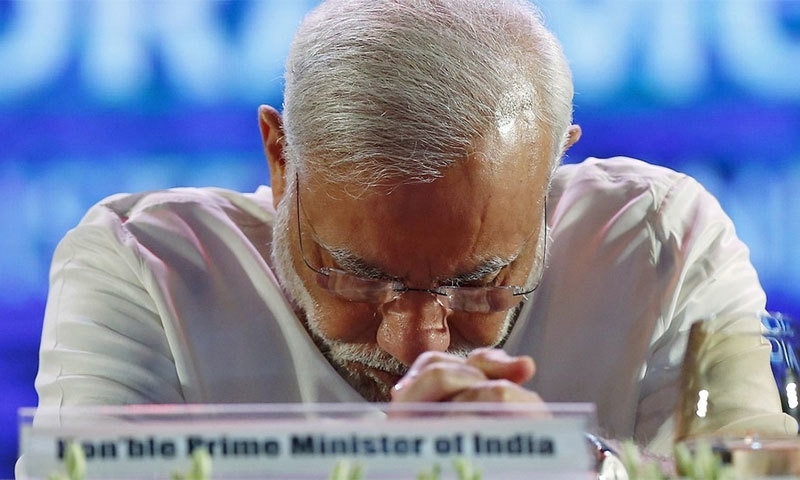

Prime Minister Narendra Modi has vowed not to compromise the interests of Indian farmers, even if it entails a heavy price.

Modi is also moving to burnish ties with China, planning his first visit there in seven years at the end of the month.

TEXTILE PRODUCTION ALREADY HALTED

The Federation of Indian Export Organisations (FIEO) said on Tuesday the higher tariffs would expose about 55 percent of US-bound shipments to “pricing disadvantages” and make them “uncompetitive” with goods from countries such as Vietnam, the Philippines and China.

It said manufacturers in key textile production hubs across India had already halted production and that seafood exporters were staring at “disrupted supply chains” and “farmer distress”.

The federation said that order cancellations also loomed large on labour-intensive export sectors such as leather, chemicals, handicrafts and carpets.

FIEO President S C Ralhan said in the statement there was an immediate need for government support, including liquidity-easing measures for exporters.

The statement said, “FIEO appeals for swift, coordinated action among exporters, industry bodies, and government agencies to protect livelihoods, reinforce global trade links, and navigate this turbulent phase.”

“The steps taken now will determine how effectively India withstands external shocks and reasserts its presence in the global export landscape,” it said.

India is not a manufacturing powerhouse but economists estimate that its GDP growth could slip below six percent this fiscal year if the 50 percent tariffs kick in.

That would mean missing the central bank’s projection of 6.5 per cent growth.

Indian stocks fell on Tuesday ahead of the likely US tariff move, with the benchmark Nifty index ending down a little over 1 per cent.