- Web Desk

- 1 Hour ago

Ceasefire, IMF cash injection poised to lift Pakistan stocks: analysts

-

- Syed Raza Hassan Web Desk

- Today

KARACHI: Analysts anticipate a strong stock market rebound on Monday after nuclear-armed Pakistan and India agreed to a full and immediate ceasefire on Saturday, following US President Donald Trump’s intervention.

All eyes are now on a potential meeting between the two South Asian rivals at a neutral venue, though details remain sketchy.

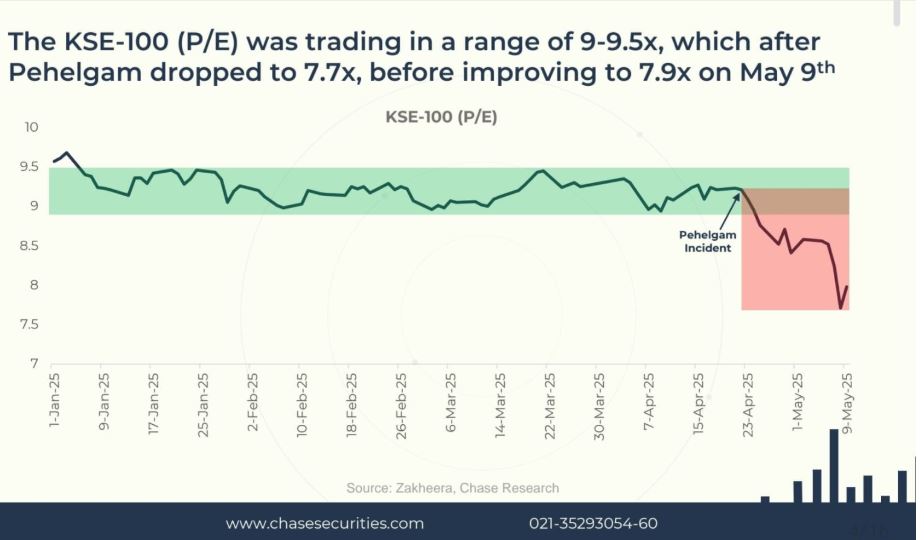

The KSE-100 Index declined by 7.2 per cent on a week-on-week basis, largely due to the escalation of tensions between India and Pakistan, as the two-week-long cross-border hostilities kept investors on edge.

“We anticipate a strong market rebound as de-escalation unfolds, underpinned by improving macroeconomic conditions. This supports our case for the KSE-100 to reach our December 2025 target of 165,215, aided by single-digit interest rates,” Muhammad Awais Ashraf, Director Research at AKD Securities, told HUM News English on Sunday.

During past periods of geopolitical tensions, the market has typically declined by a maximum of 8 per cent. This time, it corrected by 13 per cent before recovering 3 per cent on Friday. On average, the market has delivered returns of 6 per cent during such episodes—rising to 8 per cent when excluding the 2019 Balakot incident. In the three months following de-escalation, the KSE-100 has typically posted average gains of 5 per cent—and 17 per cent from troughs during periods of heightened tension, Ashraf added.

“We maintain our ‘Overweight’ stance on Banks, E&Ps, Fertilizers, Cement, OMCs, Autos, Textiles, and Technology sectors, which are poised to benefit from monetary easing, structural reforms, and reciprocal tariff measures,” he said.

During the preceding week, individuals and mutual funds (on redemption) were the primary sellers, while local institutions—including banks, companies, insurance firms, and other organisations—absorbed much of the selling, Topline Securities Ltd stated.

“Yesterday’s ceasefire announcement is expected to have a positive impact on the stock market, boosting investor confidence and potentially leading to market gains,” Mohammad Rizwan, Director at Chase Securities, told HUM News English on Sunday.

The reduced tensions and increased stability are likely to attract investors, driving growth in key sectors such as oil and gas exploration, banking, cement, and fertilizers, he added.

“The market should react positively, as the overhang of the ongoing conflict has now been removed,” Samiullah Tariq, Head of Research and Development at Pakistan Kuwait Investment Company (Private) Ltd, told HUM News English.

Analysts also believed the Pakistan Stock Exchange could also benefit from improved investor sentiment after the International Monetary Fund’s (IMF) executive board approved the first review of its $7 billion programme with Pakistan — freeing up a $1 billion tranche and bringing total disbursements to $2 billion—an announcement welcomed by Prime Minister Shehbaz Sharif, who expressed satisfaction over the IMF’s continued support, as stated by his office on Friday.