- Web Desk

- Feb 24, 2026

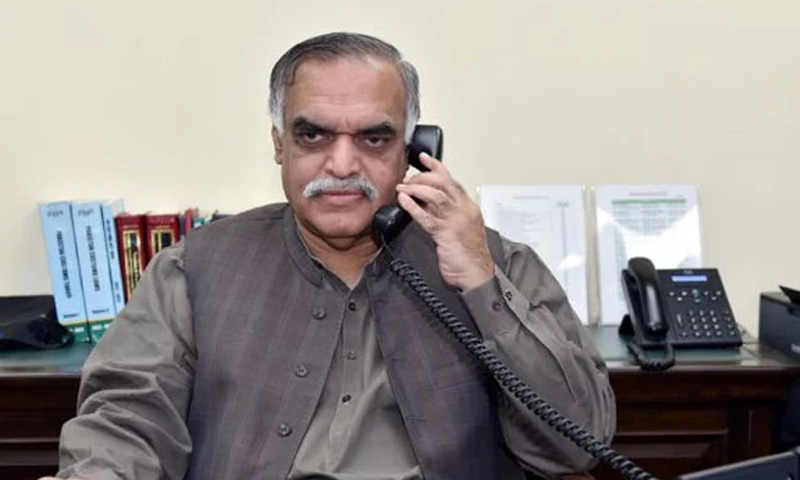

Salaried class pays Rs375bn, retailers only Rs5bn in taxes: FBR chairman

-

- Web Desk

- Jun 16, 2024

ISLAMABAD: Federal Board of Revenue (FBR) Chairman Zubair Amjad Tiwana has revealed that 360,000 retailers across the country are contributing only Rs4 billion to Rs5 billion in annual tax.

In a briefing to the Senate Standing Committee on Finance, Tiwana stated that the salaried class in the country is contributing Rs375 billion to the national treasury through taxes. He also noted that exporters are paying only Rs100 billion in tax annually.

He mentioned that the FBR has implemented measures to bring more retailers into the tax net, with the expectation that tax collection from retailers will increase to Rs50 billion in the next financial year.

Tiwana further shared that the IMF had initially demanded uniform tax slabs for both salaried and non-salaried classes, with rates higher than 45 per cent. However, after extended negotiations, the IMF agreed to lower tax rates for the salaried class.

It is noteworthy that the government has placed the entire burden of meeting tax targets on the salaried class, heavily impacting them in the budget.

Also read: FBR targets Rs3.8 trillion tax collection in next FY

While the federal budget includes salary increases for government employees, there is no assurance of salary hikes for private sector employees.

Individuals with a monthly income of Rs50,000 have been exempted from income tax. However, the income tax for those earning Rs600,000 to Rs1.2 million per year has been fixed at 5 per cent. Income tax on monthly incomes up to Rs100,000 has also been fixed at 5 per cent, with the monthly tax amount increasing from Rs1,250 to Rs2,500.

Tax on annual income of Rs1.2 million to Rs2.2 million has been fixed at 15 per cent. For those earning up to Rs183,344 per month, a 15% income tax has been imposed, increasing their tax from Rs11,667 to Rs15,000 per month.

A tax rate of 25 per cent has been set for annual incomes of Rs2.2 million to Rs3.2 million. A tax of 25 per cent has been imposed on a monthly salary of Rs267,667. Their monthly income tax has increased from Rs28,770 to Rs35,834.

For annual incomes of Rs3.2 million to Rs4.1 million rupees, the tax rate has been set at 30 per cent. Monthly incomes up to Rs341,667 will see their tax deduction of 30 per cent, with an increase in monthly tax from Rs47,408 to Rs53,333.

A 35 per cent tax will be applied to annual salaries of Rs4.1 million rupees and above.