- Web Desk

- 5 Minutes ago

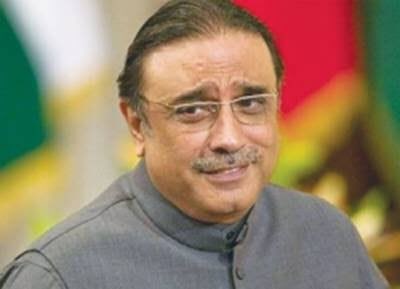

President Zardari approves “Tax Laws (Amendment) Bill 2024”

-

- Web Desk

- May 04, 2024

ISLAMABAD: President Asif Ali Zardari approved the new “Tax Laws (Amendment) Bill 2024” on Friday in accordance with article 75 of the constitution.

The bill is designed to introduce amendments to existing tax and duty regulations and will targets key sections of both the “Sales Tax Act 1990” and the “Federal Excise Act 2005”.

Read more: No proposal sent to govt for tax on solar panels: Power Division

The proposed amendments to sections 30DD, 43, 45B, 46, and 47 of the Sales Tax Act 1990, aim to streamline the taxation framework, enhancing efficiency and clarity in tax assessment and collection.

Similarly, amendments to Sections 29, 33, 34, and 38 of the Federal Excise Act 2005, seek to bolster excise taxation mechanisms for improved revenue generation.

Sections 122A, 124, 126A, 130, 131, 132, 133, and 134A of the Income Tax Ordinance 2001 have also been amended.

The bill received unanimous approval from the National Assembly on 29 April while the president’s approval came on the advice of the Prime Minister Shehbaz Sharif.

Read more: Tax delays: PM Shehbaz suspends Inland Revenue chief, officials

The implementation of the Tax Laws Amendment Bill 2024 is expected to bring “tangible improvements” in tax administration and compliance. The bill aims to modernise and streamlining regulations of tax collection in the country.

The government has stated that the bill aims to create a “conducive environment” for businesses while ensuring “fiscal sustainability”.