- Web Desk

- 1 Hour ago

Agri-sector projects healthy growth in 2QFY23-24

-

- ayesha khatoon

- Apr 08, 2024

Pakistan’s agriculture sector has outperformed with bumper output of major crops like rice, cotton and maize, maintaining a healthy growth successively for the second quarter (October-December) of current fiscal year 2023-24 at 5% and playing a major role in achieving a 1% economic growth in the three months.

The production of the staple crop of wheat is also projected to remain bumper in the ongoing Rabi season. This is expected to keep the sector as ‘king of the ring’, ensuring national food security and proving it remains backbone of the domestic economy.

Finance Minister Muhammad Aurangzeb has defined agriculture as one of the two major sectors which is extending full support in advancing growth this year (FY24) and in the next year (FY25) as well.

Pakistan Cotton Ginner’s Association (PCGA) has reported this week the commodity output spiked 71% to 8.40 million bales so far this season compared to 4.91 million bales at this time last year.

The performance of the agriculture sector is strongly believed to remain outstanding with special focus of the Special Investment Facilitation Council’ (SIFC) on the sector to invite foreign investment and increase the crops per acre yield to international standards to not only winning self-sufficiency, but also to export the surplus production and earning the much-required foreign exchange reserves.

The production of the cash crop of cotton is projected to hit almost a decade high in the range of 8.5 million bales to 9 million bales in FY24. Pakistan Cotton Ginner’s Association (PCGA) has reported this week the commodity output spiked 71% to 8.40 million bales so far this season compared to 4.91 million bales at this time last year. The turnaround is being recorded after a significant portion of the crop was washed away in September 2022 floods, saving over a billion dollar in import of the commodity this year compared to the elevated reliance on international cotton last year.

The availability of favourable weather conditions, coupled with announcement of the support price (minimum purchasing price) for the commodity for the first time in multi-decades by the government at Rs8,500 per 40 kg, played critical role in spiking the output this year.

US Department of Agriculture (USDA) reported in December 2023 Pakistan is estimated to harvest rice at 9 million tons in FY24 that is close to record high in a year and significantly higher than 5.5 million ton taken in the flood hit year in FY23.

With large exportable supplies, competitive prices, and India’s rice export ban, rice exports were at near record levels at 4.8 million ton during the final quarter of 2023. This pace is expected to continue, leading to the 5 million ton export forecast in 2024.

The government reported this week major crops have grown by 8.12% in the second quarter alone, achieving bumper output for important crops like cotton, rice and maize. Wheat output, which is yet to make its impact in the sector and the overall growth in the months to come, has increased almost 7% this year compared to last year.

The ministry of finance in its latest monthly economic outlook for March 2024 said the wheat sowing for the current Rabi season 2023-24 has surpassed the target covering an area of 9.160 million hectare against the target of 8.998 million hectare. This can be attributed to the timely availability of quality seeds, fertilizers, agriculture credit disbursements as well as a rise in mechanization. “These developments will augur well to mark the wheat production target of 32.12 million tons.”

While elaborating his economic roadmap last week in Karachi, Finance Minister Aurangzeb said wheat production remains below 40 maund per acre in Pakistan that is significantly lower than peer countries. The output can easily be enhanced to 40 maund per acre to achieve self-sufficiency for the staple crop and the production beyond 40 maund per acre would enable the nation to export it and earn the precious foreign exchange, going forward.

The output of sugarcane, which is also ranked among major crops of the country, however, suffered a drop of almost 11% this year compared to last year. The losses were offset by growth in other four major crops.

Livestock remained stable at previous year level, while forestry and fishing have also retained their normal growth trend this year, according to the National Accounts Committee (NAC).

Bumpy outlook

In the middle of all this outstanding happenings at present, the outlook for the sector becomes a little bit worrisome after the government estimated a 30% water shortage at the beginning of the upcoming Kharif season. This coupled with notable surge in fertiliser price in the wake of ending supply of subsidised gas to the urea manufacturers, putting the future of the sector on bumpy roads.

“The Rabi season crops productions depends on the weather changes during growing seasons particularly near maturity of the wheat crop,” according to the Finance Ministry.

The Indus River System Authority (IRSA) has estimated water shortage of up to 30% for the upcoming Kharif season, warning the shortage may remain even higher at the time of sowing cotton, rice and maize crops. The shortage is likely to gradually reduce to 7% during the late season.

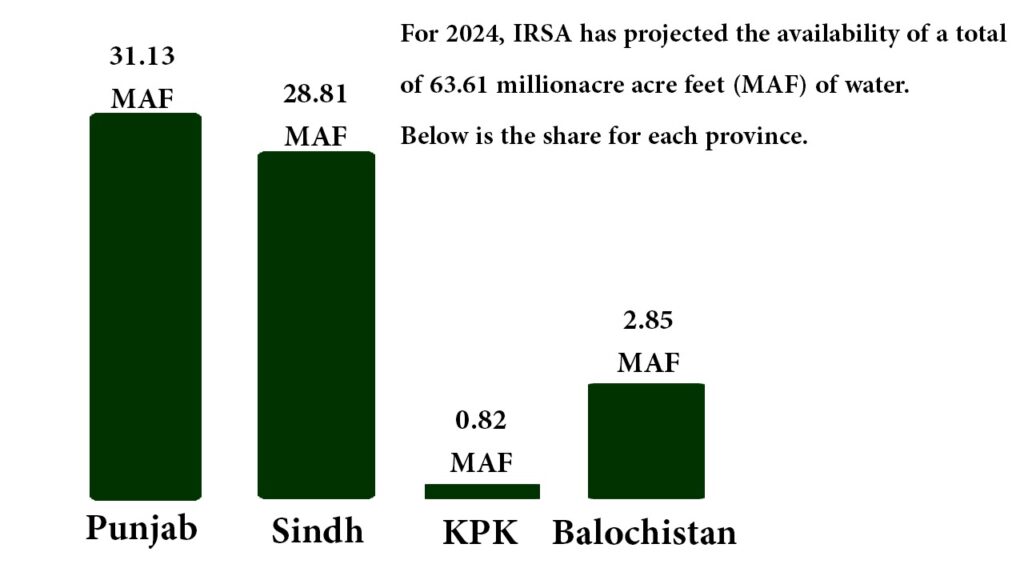

The Kharif season runs from April to September. For 2024 season, the water regulator has projected the availability of a total of 63.61 million acres feet (MAF) of water. Out of this, Punjab will get 31.13 MAF, Sindh, 28.81 MAF, Khyber-Pakhtunkhwa, 0.82 MAF and Balochistan would receive 2.85 MAF of water.

Wheat production remains below 40 maund per acre in Pakistan that is significantly lower than peer countries. The output can easily be enhanced to 40 maund per acre to achieve self-sufficiency for the staple crop and the production beyond 40 maund per acre would enable the nation to export it and earn the precious foreign exchange, going forward.

Finance Minister Muhammad Aurangzeb

Besides, the Pakistan Meteorological Department (PMD) has forecasted higher temperatures during Kharif season which may impact the crop output.

In addition to this, the government has stopped supplying subsidized gas to fertilizer manufacturers to stop smuggling of it to the bordering countries and provide direct subsidy to farmers rather than through urea sales. The move has caused officially doubling urea price to near Rs 5,000 per 50 kg bag from the previously announced official price of Rs 2,500.

The urea, however, was not available at the official price in the recent past, but was being sold at around Rs 5,000 per bag, as it was being stocked and smuggled to the nearby countries offering higher price for Pakistani urea.

The government is required to come into action to overcome water shortage and control skyrocketing urea price to ensure continuity in agriculture growth at times when industrial and services sectors’ performance remain muted.